Thinking about student housing investments? We weigh the massive rental yields against the chaotic turnover to see if this niche strategy is right for your portfolio.

Table of Contents

I still remember the first time I walked into a rental unit near the university campus just after the tenants had moved out. It was… impressive, in the worst way possible. There was a traffic cone in the living room, a mysterious sticky substance on the ceiling (how?), and a sofa that had definitely seen better days. My contractor looked at me and shook his head. “You sure about this?” he asked.

I looked at the rent roll in my hand, smiled, and said, “Absolutely.”

That is the paradox of student housing investments. It is a sector defined by chaos, high turnover, and wear and tear that would make a standard landlord weep. But it is also one of the most recession-proof, high-yield asset classes on the planet. While other investors are sweating over vacancy rates in their luxury condos, student housing landlords are often cashing checks backed by parental guarantees.

If you are considering dipping your toes into the world of student housing investments, you need to know what you are signing up for. It’s not passive income; it’s an active business. But if you can stomach “The Turn,” the profits are often double what you’d get on a standard family rental.

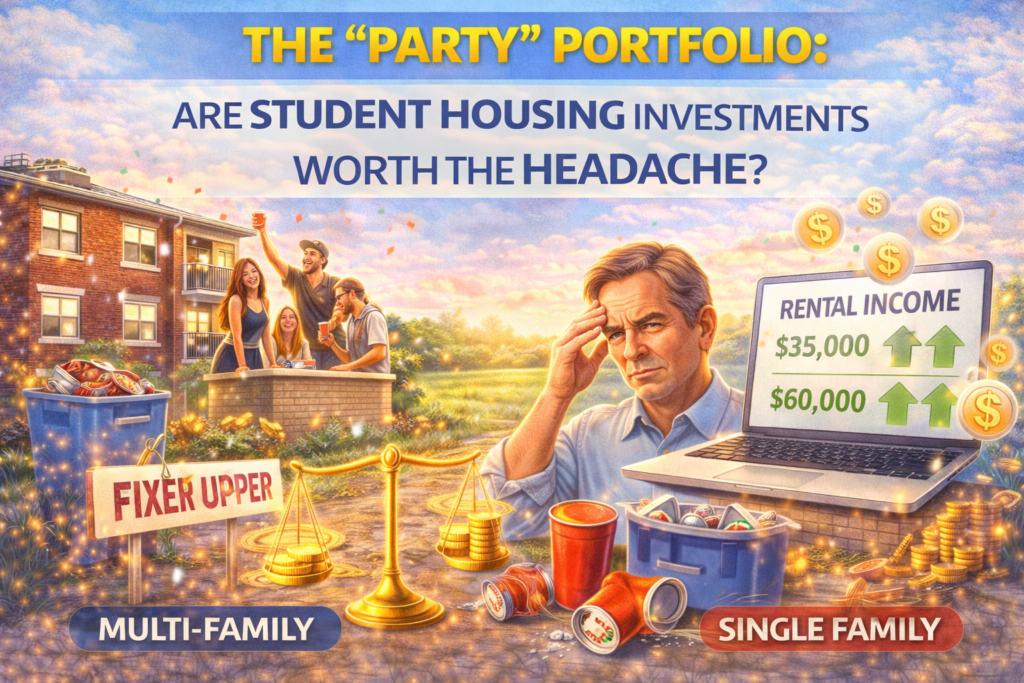

The Math: Renting by the Bed vs. the Door

Why do we do it? Why do we put up with the noise complaints and the weekend parties? It comes down to one simple metric: Rent per bed.

In a traditional single-family rental, you rent the house. Let’s say a 4-bedroom house in a nice suburb rents for $2,200 a month. That’s your cap.

With student housing investments, you ignore the house and rent the bedroom. In a college town, that same 4-bedroom house might rent for $800 per room.

- $800 x 4 bedrooms = $3,200/month.

You just increased your Gross Rental Income by $1,000 a month simply by changing your target demographic. This massive difference in rental yield is the primary driver for investors entering this space. When you multiply this across a portfolio, the capitalization rate (cap rate) on student properties often significantly outperforms the local residential average.

The “Guaranteed” Rent Check

There is a myth that students are risky tenants because they don’t have jobs. This is technically true—most full-time students are broke. But that isn’t who pays the rent.

Successful student housing investments rely on one golden piece of paper: the Parental Guarantee (or cosigner form).

When I lease a unit to a 19-year-old sophomore, I am not underwriting the student. I am underwriting their parents, who usually have 20 years of credit history, steady jobs, and a terrifying fear of their child’s credit being ruined before they graduate. In my experience, default rates in student housing investments are shockingly low. Parents will skip their own latte habits to ensure little Timmy doesn’t get evicted during finals week.

The Recession Hedge

Real estate is cyclical. We all know this. But education is what we call “counter-cyclical.” When the economy tanks and jobs are scarce, what do people do? They go back to school to get a degree or upskill.

During the 2008 crash and even the uncertain times of the early 2020s, enrollment in universities remained robust. This demand stability makes student housing investments a fantastic hedge for your portfolio. While commercial office space is struggling with the work-from-home revolution, students still physically need a place to sleep near campus.

Link to National Center for Education Statistics on enrollment trends

The Dark Side: Surviving “The Turn”

Now, let’s talk about the pain. If you are going to succeed in student housing investments, you have to master “The Turn.”

In traditional real estate, you might have a vacancy once every two or three years. In student housing, your entire portfolio goes vacant on the exact same day—usually July 31st. You then have roughly 10 to 15 days to paint, clean, repair holes in the drywall, and fix broken blinds before the new tenants move in on August 15th.

It is a logistical nightmare. It requires an army of cleaners and handymen on standby. If you miss the deadline, you have homeless students and angry parents blowing up your phone. This intense seasonal occupancy cycle is the main reason many passive investors shy away from student housing investments. You cannot manage this from a beach in Bali unless you have an incredible team on the ground.

Location: The 5-Minute Rule

In this niche, “Location, Location, Location” should be changed to “Distance, Distance, Distance.”

Students are lazy. I say that with affection, but it’s true. A property located directly across the street from campus will command a 30% premium over a nicer property that is a 15-minute drive away.

When scouting for student housing investments, get out of your car and walk. Can you get to the library in 10 minutes? Is there a coffee shop or a bar nearby? If the answer is no, you will struggle to fill vacancies. The best student housing investments are often the ugliest houses in the best locations. Students will trade granite countertops for an extra 20 minutes of sleep every morning.

Durability Over Luxury: Bulletproofing Your Asset

Forget the hardwood floors. Forget the expensive chandeliers. When you are renovating for student housing investments, your goal is durability.

You are building a tank, not a museum.

- Flooring: Use high-traffic Luxury Vinyl Plank (LVP). It’s waterproof and scratch-resistant.

- Paint: Use semi-gloss or satin. Flat paint scuffs if you look at it wrong.

- Blinds: Don’t buy the cheap plastic ones; they will break in week one. Get faux wood or durable rollers.

The wear and tear in this asset class is higher than anywhere else. Your budget for property maintenance needs to be about 1.5x what you would budget for a normal rental. If you go into student housing investments thinking you can skimp on repairs, your asset will deteriorate faster than you can imagine.

Purpose-Built Student Accommodation (PBSA)

The market is evolving. We are seeing a rise in “Purpose-Built Student Accommodation” (PBSA)—massive complexes with gyms, pools, and study halls designed specifically for students.

If you are a smaller investor looking at single-family homes or small multiplexes, you might worry about competing with these giants. Don’t be. There is always a segment of the student population that wants to escape the dorm-style living of PBSA. They want a backyard, a porch, and a feeling of independence. That is where niche student housing investments shine.

Link to Savills Global Student Housing Report

Regulatory Risks: The Town vs. The Gown

One hidden risk in student housing investments is local zoning. Many university towns have “unrelated persons” ordinances. This means it might be illegal to have more than three unrelated people living in a single house, even if it has five bedrooms.

I’ve seen investors buy massive 6-bedroom Victorians thinking they struck gold, only to be slapped with a cease-and-desist from the city because they violated the local HMO (House in Multiple Occupation) laws. Before you make any student housing investments, check the local zoning code. Do not assume you can just stuff students into every available room.

Financing and Exit Strategy

Banks can be tricky with this asset class. If you are buying a single-family home but valuing it based on per-room rent, the appraiser might not agree with your numbers. They will appraise it as a standard home.

This means student housing investments often require larger down payments or specific commercial financing if you are buying larger multi-unit properties.

However, the exit strategy is strong. Because these properties generate such high cash flow, they are attractive to other investors. You aren’t just selling a house; you are selling a high-yield business. This liquidity makes student housing investments a flexible asset to hold or flip.

Is It Right for You?

If you are the type of landlord who gets emotional about a scratch on the floor, run away. Run far away. Student housing investments require a thick skin and a business-first mindset.

But if you are looking for aggressive cash flow and have the patience to set up systems for screening and turnover, there is no better niche. The profits I’ve made from student housing investments have funded my other, more “boring” real estate deals. It’s the engine that drives the portfolio.

FAQ Section

1. Do students really pay rent on time? Surprisingly, yes. Because most leases are backed by parental guarantees, rent collection is rarely an issue. Most property management software allows parents to set up auto-pay directly, so the money never even touches the student’s hands.

2. How do I handle the summer months when school is out? Always sign 12-month leases. Never sign a 9-month lease. In student housing investments, it is industry standard for the lease to run August to July. Even if the student goes home for the summer, they (or their parents) are still responsible for the rent.

3. What happens if one roommate leaves? Structure your leases as “Joint and Several Liability.” This legal term means that every person on the lease is responsible for the entire rent amount. If one roommate drops out, the remaining roommates (and their cosigners) are legally required to cover the shortfall.

4. Is it better to buy condos or houses for students? Houses generally offer better yields and no HOA fees. Condos can be risky for student housing investments because many HOAs have strict rules against short-term rentals or student tenants, and they can fine you into oblivion.

5. How much should I budget for turnover costs? A good rule of thumb for student housing investments is to budget $500–$800 per unit (or per house) specifically for the August turnover. This covers deep cleaning, paint touch-ups, and minor repairs.

Conclusion

Student housing investments are not for the faint of heart. It is a high-octane, high-touch sector of real estate that demands your attention. But in exchange for the chaos, you get recession resistance and rental yields that traditional landlords can only dream of.

If you are willing to trade a little peace and quiet for a much healthier bank account, it might be time to look at that run-down house near campus a little differently. It’s not a mess; it’s a goldmine.