The 2026 roll call is homeownership : Is 2026 the year you finally stop paying your landlord’s mortgage and start paying your own? If you have been watching the headlines, you know that the real estate market has shifted. Gone are the days of the 2021 frenzy, but in their place is a new landscape defined by stabilizing interest rates, tech-driven appraisals, and a renewed focus on “attainable” housing.

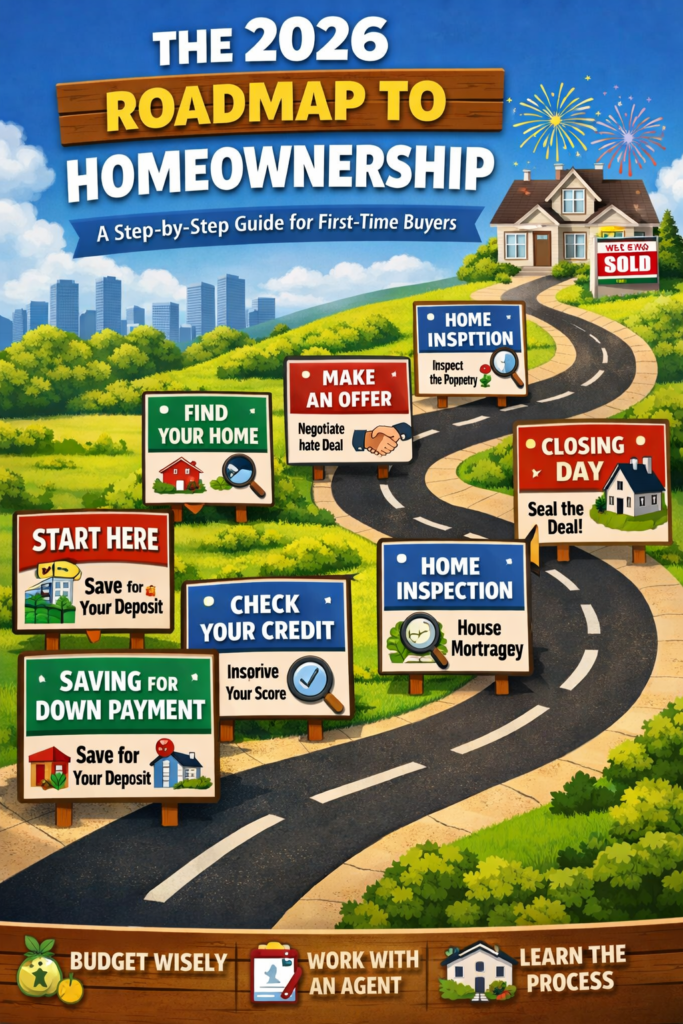

Buying your first home is likely the biggest financial transaction of your life. This guide is your 2026 roadmap—designed to take you from “just browsing” to holding the keys to your first front door.

Table of Contents

Phase 1: The 2026 Financial Gut Check

In 2026, lenders will have become more sophisticated. While your credit score still matters, banks are now using “expanded cash-flow analysis,” looking at your history of rent payments and utility bills to determine your reliability.

1. Fix Your Credit (The 700+ Goal)

To snag the best 2026 mortgage rates—currently hovering around 6.09% for 30-year fixed loans—you want a credit score of 700 or higher.

Action Step: Download your report from AnnualCreditReport.com and dispute any mistakes immediately.

Pro Tip: Avoid opening new credit cards or financing a car at least 12 months prior to your home search.

2.”Tarue Coast” budget is done

Most first-time buyers make the mistake of saving only for a down payment. In 2026, you must account for the “Big Three” upfront costs:

Down Payment: (3% to 20% of the purchase price)

Closing Costs: (Typically 2% to 5% of loan amount)

The “Emergency Buffer”: At least 1% of home’s value for immediate repairs.

Phase 2: Navigating 2026 Mortgage Options

The “one-size-fits-all” mortgage is dead. 2026 offers specialized producers that didn’t exist just a few years ago.

F. Conventional: Which is for you?

FHA loans: Ideal for buyers with credit scores as low as 580. You only need 3.5% down. However, you’ll pay Mortgage Insurance Premiums (MIP) for the lifetime of the loan.

Conventional 97: A popular 2026 option that allows for just 3% down for first-time buyers with strong credit.

VA and USDA: If you are a veteran or purchasing in a designated rural area, these 0% down options remain the gold standard for affordability.

The Rise of the “Night Buoy-Down”

In 2026, many builders and sellers are offering “2-1 buy-downs.” This means the seller pays to reduce your interest rate by 2% in the first year and 1% in the second year, giving you a “slow start” on your full mortgage payment.

Phase 3: The Search & The “Lifestyle” Filter

With inventory levels up roughly 20% compared to last year, 2026 buyers will finally have the luxury of choice. However, higher supply means that you need to be more disciplined about what you’re looking for.

1. The 5-Year Rule

Don’t buy it for the life you have today; Buy for the life you will have in five years. Does the house have a dedicated “Zoom Room” or office space? Is there an EV charging port? These are no more “luxury” features; In 2026, they are essential for the resale value.

2. Digital vs. Physical Tours

Use 3D virtual tours (like Matterport) to narrow your list of 20 homes down to 5. This saves you time and “tour fatigue.” But never buy sight-unseen—the “smell test” is one thing AI still can’t do for you.

Phase 4: Making an Offer That Wins (Without Overpaying)

The 2026 market is “balanced,” meaning neither the buyer nor the seller has total control.

The Strategy:

The Pre-Approval Power Move: A 2026 Pre-Approval Isn’t Just a Letter; it’s a verified “Priority Buyer” status. Presenting this shows the seller that you’ve already cleared the hard credit checks.

Inspect Contingencies: Never waive these. In 2026, savvy buyers are using “clutch inspections” which include sewer scopes and drone roof inspections.

The Escalation Clause: If you find your dream home and expect other offers, an escalation clause automatically increases your bid by a set amount (e.g., $2,000) over the next highest offer, up to a limit.

Phase 5: From Contract to Silosing

Once your offer is accepted, the “underwriting marathon” begins.

Appraisal: The bank will send an appraiser to ensure that the home is worth what you are paying.

Final Walkthrough: 24 hours before closing, visit home one last time. Ensure that the seller has not taken the chandeliers or left a pile of trash in the garage.

Signing Day: You will sign more papers than you ever thought possible. Bring your ID and a cashier’s check (or confirm your wire transfer details to avoid 2026’s prevailing wire fraud scams).

The 2026 real estate market rewards those who prepare. While prices are no longer “cheap,” the stability of the market allows for a thoughtful, calculated entry into homeownership. By fixing your credit now, exploring 2026’s various loan programs, and working with a local expert, you can transition from renter to owner with confidence.