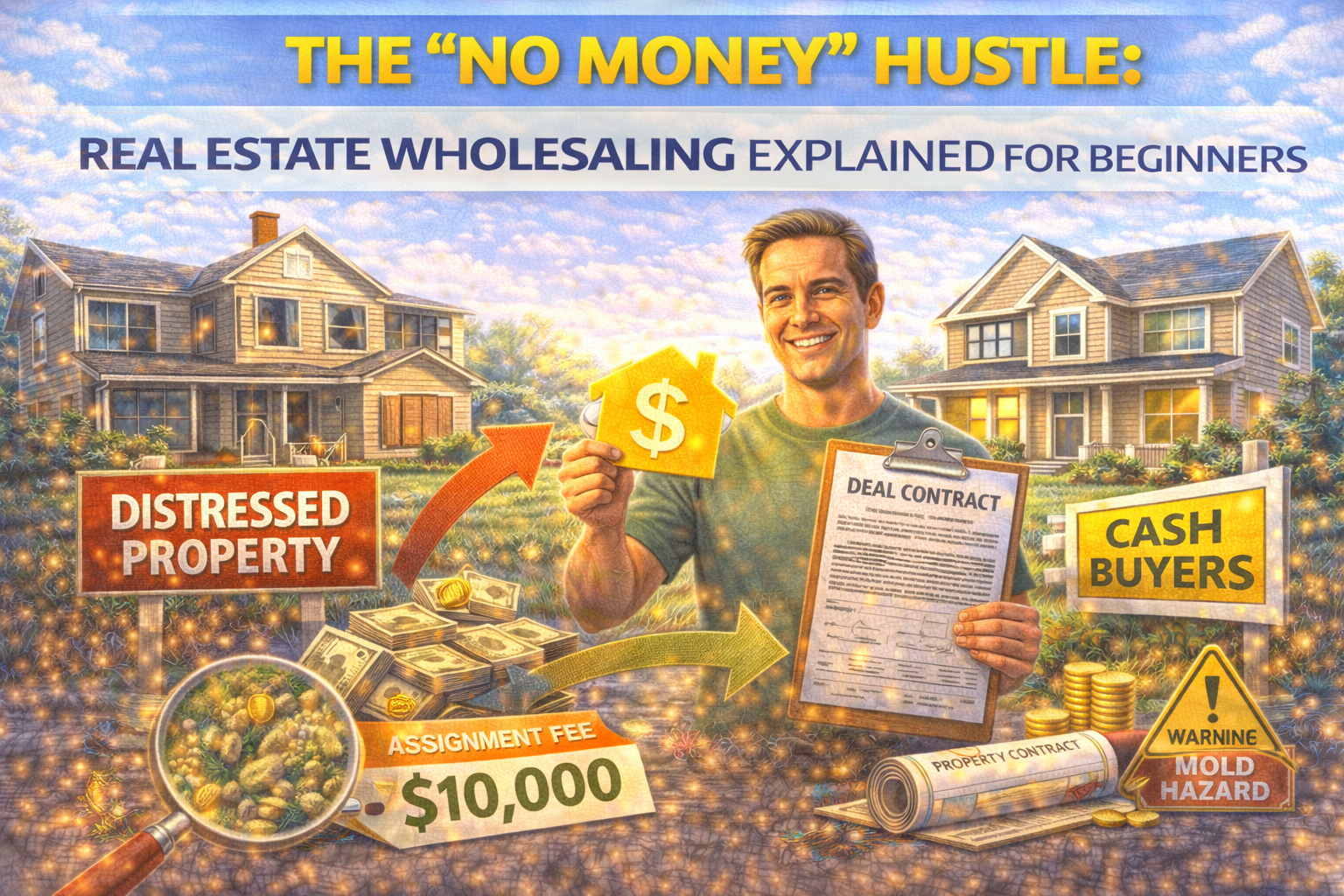

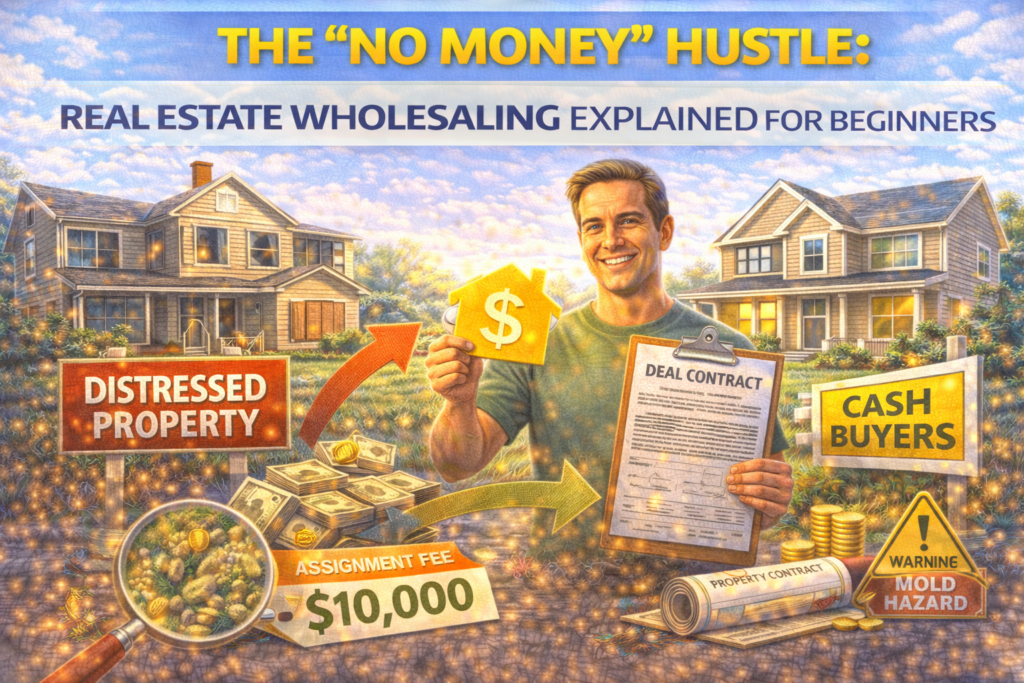

Want to break into real estate with zero cash? Learn how real estate wholesaling works. We explain how to flip contracts, find motivated sellers, and build a massive network.

Table of Contents

I still remember the late-night infomercial that started it all. A guy in a cheap suit was standing in front of a yacht, promising that I could buy houses for “no money down” and become a millionaire by Tuesday. I was skeptical. Actually, I was broke and skeptical, which is a dangerous combination. But I was curious enough to dig deeper, and that’s when I stumbled upon the gritty, unglamorous, and incredibly profitable world of real estate wholesaling.

Unlike the shiny “fix and flip” shows on TV where they argue over tile patterns, real estate wholesaling is pure hustle. It’s not about owning houses; it’s about owning paper. It’s the art of finding a deal so good that someone else will pay you for the privilege of taking it over.

If you’re sitting there with an empty bank account but a lot of ambition, this is your entry point. But let’s be real for a second: it’s not passive income. It’s a sales job disguised as investing. If you are ready to hit the pavement and talk to a lot of strangers, real estate wholesaling can change your financial life faster than almost any other strategy. Here is exactly how to flip contracts without ever fixing a toilet.

The Core Concept: You Are the Middleman

At its heart, real estate wholesaling is simple arbitrage. You aren’t buying a house; you are securing the right to buy a house.

Here is the workflow:

- You find a distressed property (think tall grass, boarded windows, or an owner behind on taxes).

- You negotiate a purchase price with the seller that is way below market value.

- You sign a contract with the seller.

- You find a cash investor (a flipper or landlord) who wants the house.

- You sell (assign) that contract to the investor for a fee.

The difference between what you agreed to pay the seller and what the investor pays you is your profit. That is the assignment fee. I’ve seen fees as small as $2,000 and as massive as $50,000. And the best part? You never actually bought the house.

Step 1: Finding the “Motivated Seller”

This is where 90% of people fail. You cannot do real estate wholesaling with houses listed on Zillow. Those sellers want full retail price. You are looking for off-market deals.

You are hunting for problems, not properties. You need to find motivated sellers—people who value speed and convenience over price. Maybe they inherited a house they don’t want, or they are facing foreclosure, or the house is just too damaged for them to fix.

I used to spend my Saturday mornings “driving for dollars.” I’d drive through older neighborhoods, looking for mail piling up in the box or gutters falling off. I’d write down the address, go home, look up the owner on the county tax records, and send them a handwritten letter. It’s tedious. It’s old school. But in real estate wholesaling, it works.

Step 2: Running the Numbers (The 70% Rule)

You can’t just pick a price out of thin air. To be successful at real estate wholesaling, you have to think like the investor who will eventually buy the contract from you.

The industry standard is the 70% Rule.

- Formula: (After Repair Value x 0.70) – Repair Costs = Maximum Offer.

Let’s say a house would be worth $200,000 all fixed up (that’s the After Repair Value or ARV). It needs $40,000 in repairs.

- ($200,000 x 0.70) = $140,000

- $140,000 – $40,000 = $100,000.

Your maximum offer to the seller should be around $100,000 minus your fee. If you want to make $10,000, you need to get that house under contract for $90,000. If you offer too much, no investor will buy the contract from you, and you’ll be stuck.

Step 3: The “Magic” Paperwork

Once the seller agrees to your price (after a lot of negotiation), you sign a Purchase and Sale Agreement. But here is the critical part for real estate wholesaling: the contract must include an “Assignment Clause.”

This little sentence basically says, “John Doe and/or assigns agrees to buy this property.” That “and/or assigns” is your golden ticket. It gives you the legal right to pass the contract to someone else.

Without this clause, you are legally on the hook to buy the house yourself. And if you don’t have the cash, you’re in trouble. Always use a contract vetted by a local real estate attorney who understands real estate wholesaling.

Step 4: Building Your Buyers List

Now the clock is ticking. You usually have about 30 days to close. You need to find a buyer, fast.

This is where your Cash Buyers List comes in. These are the flippers and landlords in your town who are always hungry for deals.

- Pro Tip: Go to local REIA meetings (Real Estate Investors Association). Walk into the room and ask, “Who is looking for a fixer-upper in [Neighborhood X]?” You will have five business cards in your hand within seconds.

When you send the deal to your list, don’t mention the real estate wholesaling fee. Just tell them the price. “Hey, I have a 3-bed, 2-bath fixer. It needs work, but the price is $100,000 cash.” (Remember, you got it for $90,000).

Step 5: The Closing Table

When an investor says “I’ll take it,” you sign an Assignment Agreement. They agree to step into your shoes and close on the property.

On closing day, the title company handles everything. The investor wires the money. The seller gets their $90,000. You get a check for $10,000. The investor gets the deed. Everyone wins. The seller got out of a problem property, the investor got a deal, and you got paid for connecting the dots. This is the beauty of real estate wholesaling.

Is It Legal? (The Big Question)

I hear this all the time: “Is real estate wholesaling actually legal?”

The short answer is yes, but you have to tread carefully. You are selling the contract, not the house. You are selling your “equitable interest” in the property.

However, some states are cracking down. Places like Illinois and Oklahoma have passed laws requiring a real estate license if you do more than one real estate wholesaling deal a year. You absolutely must check your local laws. The line gets blurry when you start marketing the house publicly (like putting it on Craigslist) rather than marketing the contract to a private list.

The Mental Game: Handling Rejection

I won’t lie to you—this business is brutal on the ego. For every one “Yes,” you will hear fifty “Nos.” You will have sellers hang up on you. You will have investors ghost you. You will have deals fall apart two days before closing because the title wasn’t clean.

To survive in real estate wholesaling, you need thick skin. You aren’t really in the house business; you are in the lead generation business. If you stop marketing, your income stops instantly.

Why Investors Love Wholesalers

You might wonder, “Why doesn’t the investor just find the deal themselves?”

Time. A busy flipper is managing contractors, permits, and budgets. They don’t have time to drive around looking for ugly houses or spend hours on the phone negotiating with a seller who is going through a divorce.

They are happy to pay your real estate wholesaling fee because you did the heavy lifting. You found the needle in the haystack. You brought them a deal on a silver platter.

Common Pitfalls to Avoid

- Overestimating the ARV: If you think the house is worth $300,000 but it’s really only worth $250,000, your numbers are trash. Be conservative.

- Underestimating Repairs: If you tell an investor it needs “a little paint” and they walk in and see a cracked foundation, you lose all credibility.

- No Earnest Money: Even in real estate wholesaling, you should put down a small earnest money deposit (maybe $10 or $100) to make the contract legally binding.

Conclusion

Real estate wholesaling is the ultimate “earn while you learn” strategy. It teaches you how to value property, how to negotiate, and how to spot a good neighborhood. It forces you to build a network of title companies, attorneys, and investors that will serve you for the rest of your career.

Is it easy? No. Is it a “get rich quick” scheme? Definitely not. But it is one of the few paths where hustle beats capital every single time. You don’t need a rich uncle or perfect credit to start real estate wholesaling. You just need a phone, a tank of gas, and the willingness to ask a stranger, “Do you want to sell your house?”

Ready to find your first deal? Start by driving your own neighborhood this weekend. Look for the house with the tall grass. That might be your first $10,000 check.

FAQ Section

1. Do I need a real estate license to wholesale? In most states, no, as long as you are selling the contract and not the property itself. However, laws are changing rapidly (like in Illinois and Philadelphia). Always consult a local real estate attorney to ensure your real estate wholesaling business is compliant.

2. How much money do I need to start? Very little. You might need a few hundred dollars for marketing (letters, signs) and a small earnest money deposit (often as low as $10). You do not need the cash to buy the house.

3. What happens if I can’t find a buyer? This is the risk. If you can’t find a buyer before your contract expires, you have to go back to the seller and cancel the contract. Most real estate wholesaling contracts have “inspection contingencies” that allow you to back out legally without penalty within a certain timeframe.

4. Can I wholesale a house listed on the MLS? It is very difficult. MLS properties are usually priced at retail, and agents rarely accept “assignable” contracts. Real estate wholesaling works best with off-market properties where there are no agents involved.

5. What is “Double Closing”? This is an alternative to assignment. Instead of assigning the contract, you actually buy the house for a split second (using transactional funding) and then immediately sell it to the investor. It keeps your profit margin private but costs more in closing fees.