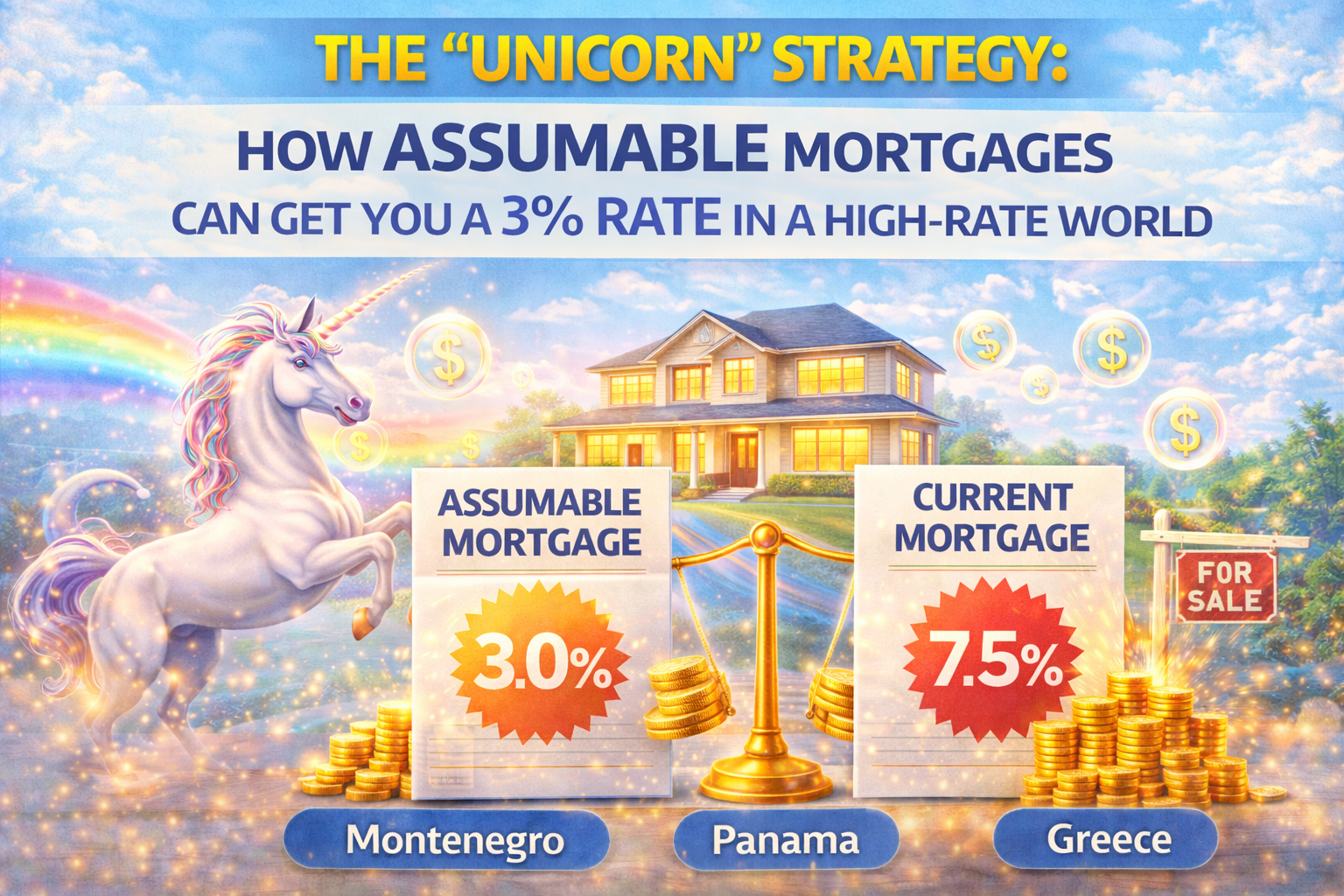

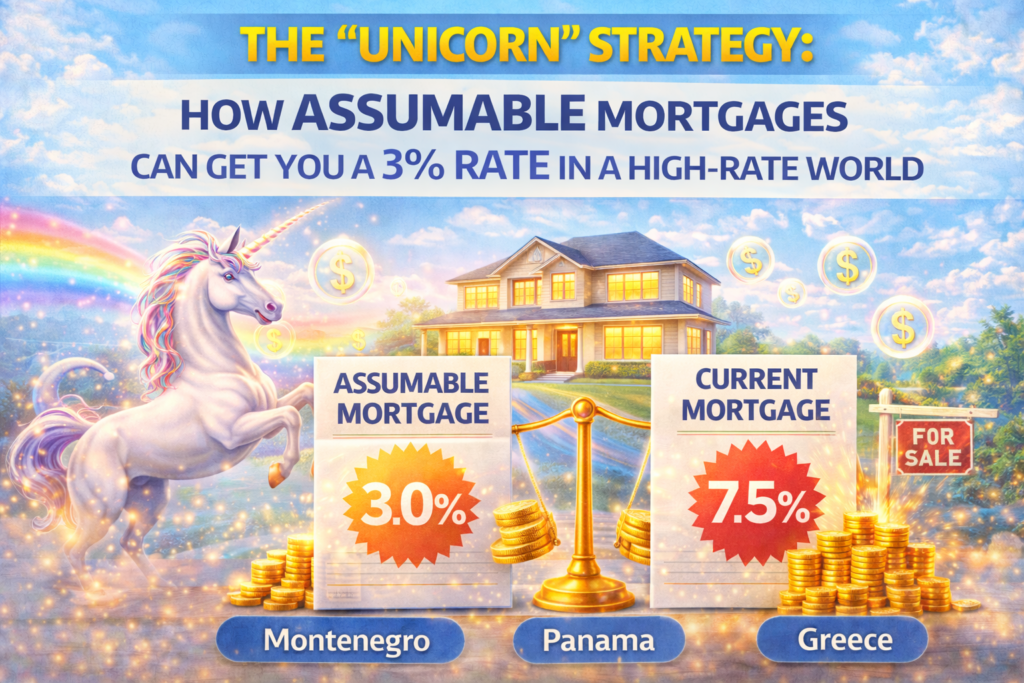

Tired of high interest rates? Assumable mortgages might be your ticket to a 3% loan. Learn how to inherit a seller’s rate and save thousands monthly.

Table of Contents

I was chatting with a first-time homebuyer last week—let’s call her Sarah—who looked like she hadn’t slept in days. She had excellent credit and a solid down payment, but every time she ran the monthly numbers on a house she liked, the current interest rates blew her budget out of the water. She looked at me and asked, “Is there a time machine I can buy to go back to 2021?”

I told her the truth: “No, you can’t buy a time machine. But you might be able to buy a seller’s old loan.”

This is the magic of assumable mortgages. In a market where affordability is the number one enemy, finding a home with an assumable loan is like finding a golden ticket. It allows you to bypass the current punishing market rates and literally “take over” the seller’s existing mortgage—interest rate, remaining balance, and all.

If you are hunting for a hack to beat the system, this is it. But before you get too excited, you need to understand that assumable mortgages are not without their headaches. They are complex, often misunderstood, and can be harder to close than a standard deal. Here is everything you need to know before you start your hunt.

What Exactly Are Assumable Mortgages?

In plain English, assumable mortgages allow a buyer to step into the seller’s shoes. Instead of applying for a brand-new loan at today’s rate (let’s say 7%), you take over the seller’s existing loan at their rate (let’s say 3.25%).

You don’t reset the amortization clock, either. If the seller has 20 years left on a 30-year mortgage, you take over those remaining 20 years. The lender transfers the debt from their name to yours.

Why is this such a big deal? The math is staggering. On a $400,000 loan, the difference between a 3% rate and a 7% rate is roughly $1,000 per month in interest alone. That is life-changing money for most families.

Not All Loans Are Created Equal

Here is the first hurdle: not every home has one. Most conventional loans (the ones backed by Fannie Mae or Freddie Mac) have what’s called a “Due on Sale” clause. This means the loan must be paid off entirely when the property is sold. You cannot assume them.

However, government-backed loans are almost always assumable mortgages. If you are scanning listings, look for these three types:

- FHA Loans: The most common type of assumable loan. You generally need to meet the lender’s creditworthiness standards, but you don’t necessarily have to be a first-time buyer.

- VA Loans: These are assumable, even by non-veterans! However, there is a catch regarding the seller’s “entitlement” (more on that in a minute).

- USDA Loans: These rural development loans are also assumable, though they are less common in suburban markets.

The “Equity Gap”: The Biggest Deal Killer

This is the part that usually breaks Sarah’s heart. Assumable mortgages only cover the remaining balance of the loan. They do not account for the home’s increased value.

Let’s look at a real-life example:

- Sale Price of Home: $500,000

- Seller’s Current Loan Balance: $300,000

- Interest Rate: 2.9%

If you assume this loan, you are taking on the $300,000 debt. But you still owe the seller $200,000 for the rest of the house value. This is called the equity gap.

You cannot just add this $200,000 to the assumable loan. You have to cover it with cash or take out a second mortgage (often called a “second lien” or HELOC). Since second mortgages come with much higher interest rates, they can eat into your savings. This is why assumable mortgages are best for buyers who have large cash down payments to cover that gap.

The Process: Patience is a Virtue

If you think getting a regular mortgage is slow, buckle up. Assumable mortgages are processed by the seller’s current loan servicer, not a hungry loan officer looking for a commission.

To be blunt, servicers don’t make much money on assumptions, so they don’t prioritize them. A standard closing might take 30 days; an assumption can take 60, 90, or even 120 days. You have to be willing to pester the loan servicer constantly to get the paperwork moving.

Special Rules for VA Loans

For my military clients, assumable mortgages come with a specific warning label. If a veteran allows a non-veteran to assume their VA loan, the seller’s VA entitlement stays tied up in that property until the loan is paid off.

This means the veteran seller won’t be able to use that portion of their entitlement to buy their next home with zero down. Because of this, many veterans will only sell to other veterans who can “substitute” their own entitlement. It’s a critical negotiation point.

Why Sellers Should Care

You might wonder, “Why would a seller agree to this headache?”

In a slow market, assumable mortgages are a powerful marketing tool. If two identical houses are for sale, but House A comes with a 3% mortgage payment and House B comes with a 7% payment, House A is going to sell faster and likely for a higher price.

Sellers can effectively “sell” their low rate as a feature, much like a renovated kitchen or a pool.

Risks to Watch Out For

When chasing assumable mortgages, you need to ensure the seller obtains a full release of liability. If this document isn’t signed by the lender, and you (the buyer) default on the loan three years later, the lender could technically come after the original seller for the debt.

For the buyer, the risk is mostly time and bureaucracy. You might spend three months trying to close, only for the servicer to deny the assumption because your debt-to-income ratio is slightly off.

Link to FHA Handbook on Assumptions

Is It Worth the Hassle?

Despite the paperwork, the equity gap, and the slow timeline, the answer is usually yes. The savings are just too massive to ignore. Over the life of a 30-year loan, the difference between 3% and 7% is hundreds of thousands of dollars.

If you have the cash to cover the gap and the patience to navigate the red tape, assumable mortgages are arguably the best investment vehicle in real estate right now. They allow you to build wealth by keeping your monthly overhead historically low.

FAQ Section

1. Can I assume a mortgage if I am an investor? It depends on the loan type. FHA and USDA loans generally require the buyer to occupy the property as their primary residence. However, if you assume a VA loan, there is technically no occupancy requirement after the assumption closes, though finding a seller willing to do this is rare due to the entitlement issue.

2. Do assumable mortgages require a down payment? Technically, no “down payment” is required for the loan itself, but you must cover the equity gap. If the gap between the purchase price and the loan balance is $100,000, you need to bring that $100,000 to the closing table, which acts as a massive down payment.

3. Are there closing costs on assumable mortgages? Yes, but they are significantly lower than a new loan. You avoid the expensive “origination fees” of a new mortgage. However, you will still pay assumption fees (capped for FHA/VA loans), title insurance, and recording fees.

4. How do I find homes with assumable mortgages? Most MLS listings will mark a property as “assumable” in the financing section, but agents often miss this. You can also use specialized platforms like Roam or simply ask your agent to filter for listings with FHA or VA loans that are 3+ years old.

5. Can I refinance an assumed mortgage later? Absolutely. If rates drop to 2% in the future (we can dream, right?), you can refinance your assumed loan just like any other mortgage. You are never “stuck” with it.

Conclusion

Finding assumable mortgages is a bit like thrifting for designer clothes. You have to dig through a lot of racks, and sometimes the fit isn’t perfect, but when you find that gem, the value is undeniable.

If you are discouraged by today’s monthly payments, stop looking for a cheaper house and start looking for a cheaper loan. Ask your real estate agent specifically to target FHA and VA listings where the owners have substantial equity.